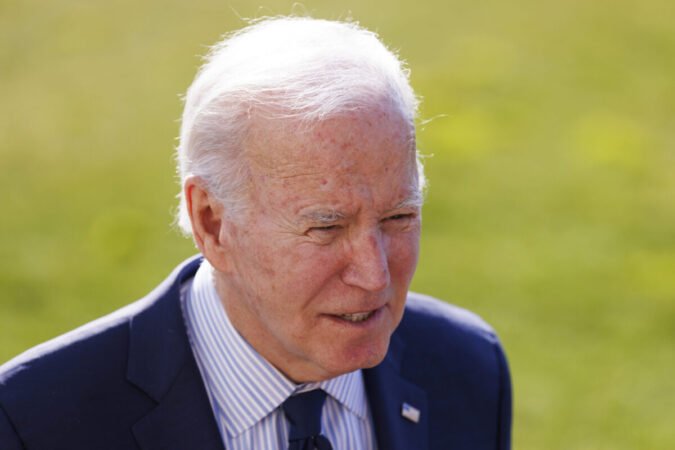

During President Biden’s State of the Union, he will unveil his plan to raise the minimum corporate tax by a whopping 40% as well as implement a tax on the rich that would be at least 25%.

Biden would raise the corporate tax rate to 28% and the corporate minimum tax to 21%. Currently, the minimum corporate tax rate stands at 15% after Biden implemented that earlier in his presidency. Biden would also refuse companies tax deductions for employees making over $1 million. “The President is proposing to levy a 25 percent minimum tax on the wealthiest 0.01 percent, those with wealth of more than $100 million,” the White House stated.

Former President Trump, the presumptive GOP 2024 presidential nominee, would reportedly make the tax cuts he implemented in his first term – which reduced corporate taxes from 35% to 21% — permanent.

During Trump’s administration, the four quarters preceding January 2019 saw real gross domestic product soar more than 3 percent, the best since the second term of George W. Bush’s presidency 13 years before.

Wharton Business School finance professor Joao Gomes, who was awarded the University of Pennsylvania’s Marshall Blume Prize in 2018, recently warned that the nation’s massive $34 trillion debt could presage an economic meltdown in 2025.

“As we discuss promises about ‘what we’re going to do with tax and programs,’ it’s going to be important to put it in the context of ‘Can we afford that?’” Gomes told Fortune. “It’s a really obvious moment in history for us to say: ‘Okay, what are our choices; what can we feasibly do; who has the better plan?’ I suspect neither party is interested in that, and it might all be pushed under the rug.”

“Toward the latter part of the decade we will have to deal with this,” he continued. “It could derail the next administration, frankly. If they come up with plans for large tax cuts or another big fiscal stimulus, the markets could rebel. Interest rates could just spike right there, and we would have a crisis in 2025. It could very well happen. I’m very confident by the end of the decade one way or another, we will be there.”

“The most important thing about debt for people to keep in mind is you need somebody to buy it. We used to be able to count on China, Japanese investors, the Fed to [buy the debt]. All those players are slowly going away and are actually now selling. … If at some moment these folks that have so far been happy to buy government debt from major economies decide, ‘You know what, I’m not too sure if this is a good investment anymore. I’m going to ask for a higher interest rate to be persuaded to hold this,’ then we could have a real accident on our hands,” Gomes stated.