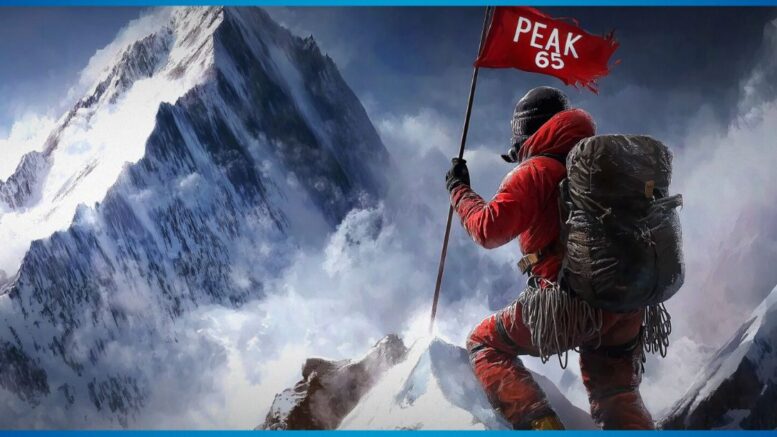

America faces the Peak 65 surge right now, with millions turning 65 and reshaping retirement forever. This massive wave started in 2024, hitting its high point this year. You need to know the facts before it’s too late.

Unmasking Peak 65: The Retirement Tsunami

Peak 65 marks the largest retirement boom in U.S. history. Over 4.1 million Americans turn 65 each year from 2024 to 2027. That’s more than 11,200 people daily entering traditional retirement age. This surge stems from the baby boomer generation, born after World War II when families grew rapidly amid postwar prosperity. But today, many lack pensions that older generations enjoyed. They rely heavily on Social Security and personal savings, which often fall short.

Experts warn this creates huge pressure on systems like Medicare and housing markets. Retirees risk outliving their money without steady income streams. Yet, powerful entities might downplay these risks. Governments and corporations could suppress full truths about Social Security’s looming shortfalls to avoid panic or policy changes. Misinformation spreads fast among those over 65, who share fake news seven times more than younger folks. This leaves many claiming benefits too early, slashing their payouts forever.

Take Sarah, a 64-year-old teacher from Ohio. She discovered Peak 65 warnings last year and transformed her plan. “I boosted my 401(k) contributions and added annuities,” she shares. Now, she feels hope instead of fear, ready for golden years filled with travel and family.

What Peak 65 Means for Your Future

Peak 65 signals a shift where self-reliance rules. Social Security faces strains as more retirees draw benefits without enough workers paying in. Healthcare costs soar, and Big Pharma might push pricey drugs while hiding affordable options. This could trap retirees in debt. Politically, it’s intriguing—postwar booms led to this, but past administrations ignored pension declines. Now, the system buckles under weight it wasn’t built for. Economies feel the hit too. Cities brace for housing shortages as boomers downsize or move south. Jobs open up, but who fills them? Millennials bear the brunt, funding this wave through taxes while saving for their own peaks.

How Retirees Tackle Peak 65 Head-On

You can prepare smartly for Peak 65. Start by assessing your nest egg. Answer key questions: How much do you need yearly? Where will income come from? Maximize Roth accounts for tax-free growth. Diversify with stocks, bonds, and real estate. Consider annuities for guaranteed income. Plan healthcare early—enroll in Medicare at 65 and add supplements. Build an emergency fund covering six months’ expenses. Delay Social Security claims until 70 for bigger checks, despite misinformation urging early grabs. There are several areas in the U.S. that have planned and made provision for the Peak 65 crisis.

Work part-time if needed and able; many boomers do. Create a withdrawal strategy. Use the 4% rule wisely, adjusting for inflation. Talk to advisors for personalized steps. Sarah did, and it sparked her transformation from worry to empowerment.

Peak 65: Your Wake-Up Call

The Peak 65 surge demands action now to secure your retirement. Don’t let suppression or myths derail you—claim your future with smart planning. Will you assess your savings today? How will you build protected income against this wave?

Be the first to comment on "Peak 65 Alert: Crisis Hits Now!"