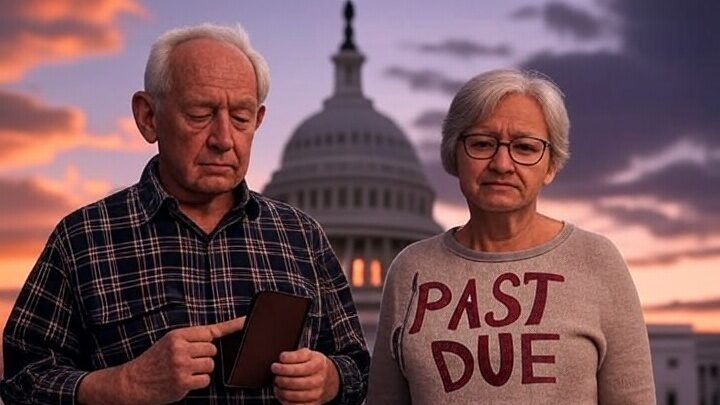

“The One, Big, Beautiful Bill,” a cornerstone of President Donald Trump’s domestic economic agenda, has passed the House and, for many reasons, should now gain Senate approval, sparking significant discussion. This is particularly true regarding its impact on Social Security (SS). Released by the House Ways and Means Committee, this nearly 1,116-page legislation proposes a range of tax reforms. Included is a $4,000 deduction for seniors aged 65 and over. This stop-gap deduction is meant to temporarily fulfilling Trump’s promise to alleviate the tax burden on fixed-income seniors. Thus, it’s a strategic move to provide immediate relief. It avoids the astronomical cost, and required lengthy process of completely eliminating Social Security taxes at this time. However, achieving the ultimate goal requires further action.

Promise Made: No Tax on Social Security

The $4,000 deduction for seniors points to a promises Trump made during his campaign. Although it doesn’t fulfill the promise, it does serve as a placeholder. More importantly it eases the current economic financial strain on fixed income retirees. The decision to opt for a deduction, in place of a complete tax elimination, is driven by fiscal and procedural considerations. Experts estimate that ending Social Security taxes would cost over $1 trillion over a decade, a figure that poses a significant challenges to the federal budget Committee for Responsible Gov.

Trump’s Strategy

The inclusion of the No Tax on S.S. reflects a broader Trump strategy to balance immediate voter need with long-term fiscal responsibility. It acknowledges the growing concern among seniors about the sustainability of Social Security amidst rising living costs and inflation. Yet, the bill’s design also considers the warnings from entities like the Committee for a Responsible which caution that such policies could accelerate the insolvency of Social Security trust funds US Budget Watch. To achieve his goal for a solid Social Security system in the future, several steps are necessary.

Five Necessary Steps to Deliver

- First, new legislation must be drafted and passed by both the House and Senate. This entails overcoming current constraints such as the Senate’s reconciliation rules that prohibit changes to Social Security. This would require bipartisan support, likely involving negotiations to secure the necessary votes.

- Second, a funding mechanism must be identified to offset the revenue loss. This potentially could occur through tax reforms targeting higher-income earners, tariffs and/or budget re-allocations.

- Third, comprehensive economic impact analyses are needed to understand the long-term effects on the federal deficit and Social Security’s sustainability according to the US Dept. of Treasury USDT.

- Fourth, Public and political support must also be cultivated, possibly through campaigns highlighting the benefits for seniors.

- Finally, parallel plans to ensure Social Security’s long-term viability, such as increasing revenue through other means or adjusting benefit formulas, are essential.

Summary: No Tax on Social Security

While “The One, Big, Beautiful Bill” offers a significant tax break for seniors, the path to eliminating Social Security taxes entirely is complex and fraught with fiscal and political challenges. It requires careful legislative action, economic planning, and a commitment to balancing immediate relief with long-term sustainability. The journey to no tax on Social Security is ongoing, demanding hard work, focused effort, and strategic policy making.