Private equity (PE) is transforming industries across America, from veterinary care to housing, often prioritizing profits over people. If you’ve noticed skyrocketing vet bills or struggled to afford a home, you might be feeling the ripple effects of private equity practices. This article explores how PE operates, using the veterinary sector as a prime example, while shedding light on its broader impact on housing, healthcare, and your wallet. Let’s define what private equity is, why it’s controversial, and how it affects everyday life.

What Are Private Equity Practices?

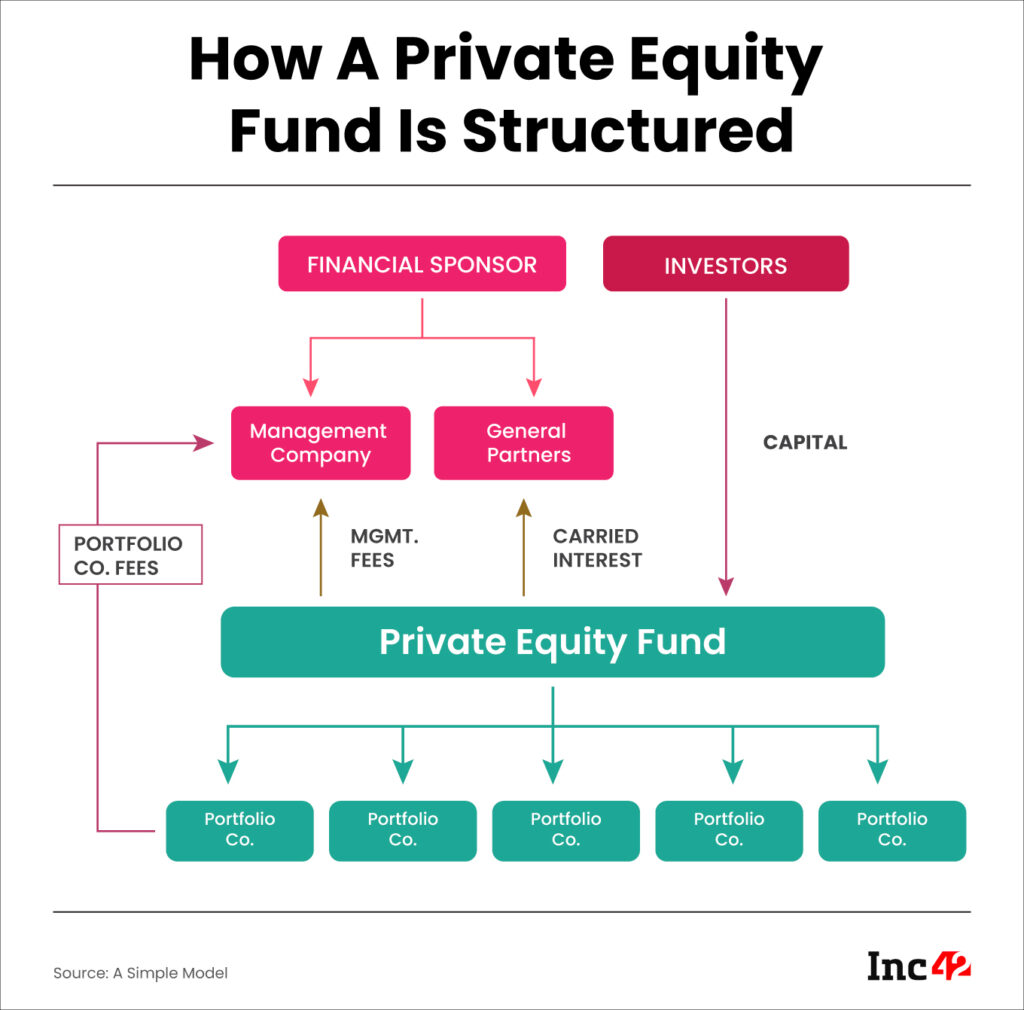

Private equity involves investment firms pooling funds to buy companies, aiming to boost profitability before selling them for a profit. Typically, PE firms acquire businesses using a mix of investor funds and borrowed money, then streamline operations or raise prices to maximize returns. While this can save struggling companies, it often leads to cost-cutting, higher fees, and reduced service quality. In veterinary care, for instance, private equity practices have sparked widespread frustration, as pet owners face inflated costs and impersonal service.

Private Equity in Veterinary Care: A Case Study

Imagine taking your dog to a trusted vet, only to find it’s been bought by a private equity firm. Suddenly, routine visits come with hefty price tags, and staff push unnecessary tests or services. This scenario reflects an ever growing trend. For instance, you may find yourself standing at the counter and hear a Staff member tell you that a teeth cleaning, for your dog, is now $2,000—five times the $400 you use to pay. Additionally, exams are now a requirement for a simple refill of prescriptions. Such private equity practices stem from firms like Mars Petcare or JAB Holding acquiring clinics, consolidating them into chains, and standardizing profit-driven models.

A 2024 report from Veterinary Economics confirms that PE-owned clinics often raise fees and upsell services to boost revenue. This shift can erode the personal touch pet owners value, as vets prioritize financial targets over animal care. This statement—“they don’t even pet my dog”—highlights how private equity practices can alienate customers, turning trusted clinics into profit machines.

Beyond Vets: Private Equity in Housing and Healthcare

Private equity’s reach extends far beyond veterinary care. In housing, PE firms like Blackstone have snapped up residential properties, driving up rents and home prices. A 2023 study from Housing Trends found that PE ownership in rental markets increased costs by 10–20% in some cities, pricing out families and young buyers. This mirrors the veterinary example, where profit motives inflate costs and limit access. In healthcare, private equity practices have similar effects. PE-owned hospitals and clinics often cut staff or raise prices to improve margins. A 2021 article from Health Affairs noted that PE acquisitions led to higher patient costs and reduced care quality in some facilities. Whether it’s vet care, housing, or healthcare, private equity practices often prioritize short-term gains, leaving consumers feeling scammed or squeezed.

Why Should You Care About Private Equity Practices?

Private equity practices affect your wallet and quality of life. Rising vet bills make pet ownership—a source of joy for many—unaffordable. In housing, PE-driven price hikes block home ownership dreams. In healthcare, profit-focused models can compromise care. These trends spark a thought-provoking question: are we losing control of essential services to profit-driven firms? The exhaustion consumers are feeling navigating a PE-dominated world is getting worse.

What Can You Do About It?

Navigating private equity’s impact requires action. Start by researching local providers—independent vets, for example, may offer fairer prices. In housing, support policies that limit PE’s grip on rentals, like those proposed in recent HUD initiatives. A visit to your local City Council meeting to express your concern could help. Advocate where you can for transparency in healthcare pricing to counter PE-driven costs. By staying informed and vocal, you can push back against profit-first models.

Private equity practices are reshaping industries, often at the expense of affordability and quality. From veterinary care to housing and healthcare, the drive for profit can leave consumers feeling hopeless and trapped. Ask yourself: how can we balance business innovation with fair access to essential services? Share your comments and experiences below to keep this conversation alive.

Be the first to comment on "Private Equity Practices: How Profit-Driven Ownership is Reshaping Veterinary Care and Beyond"